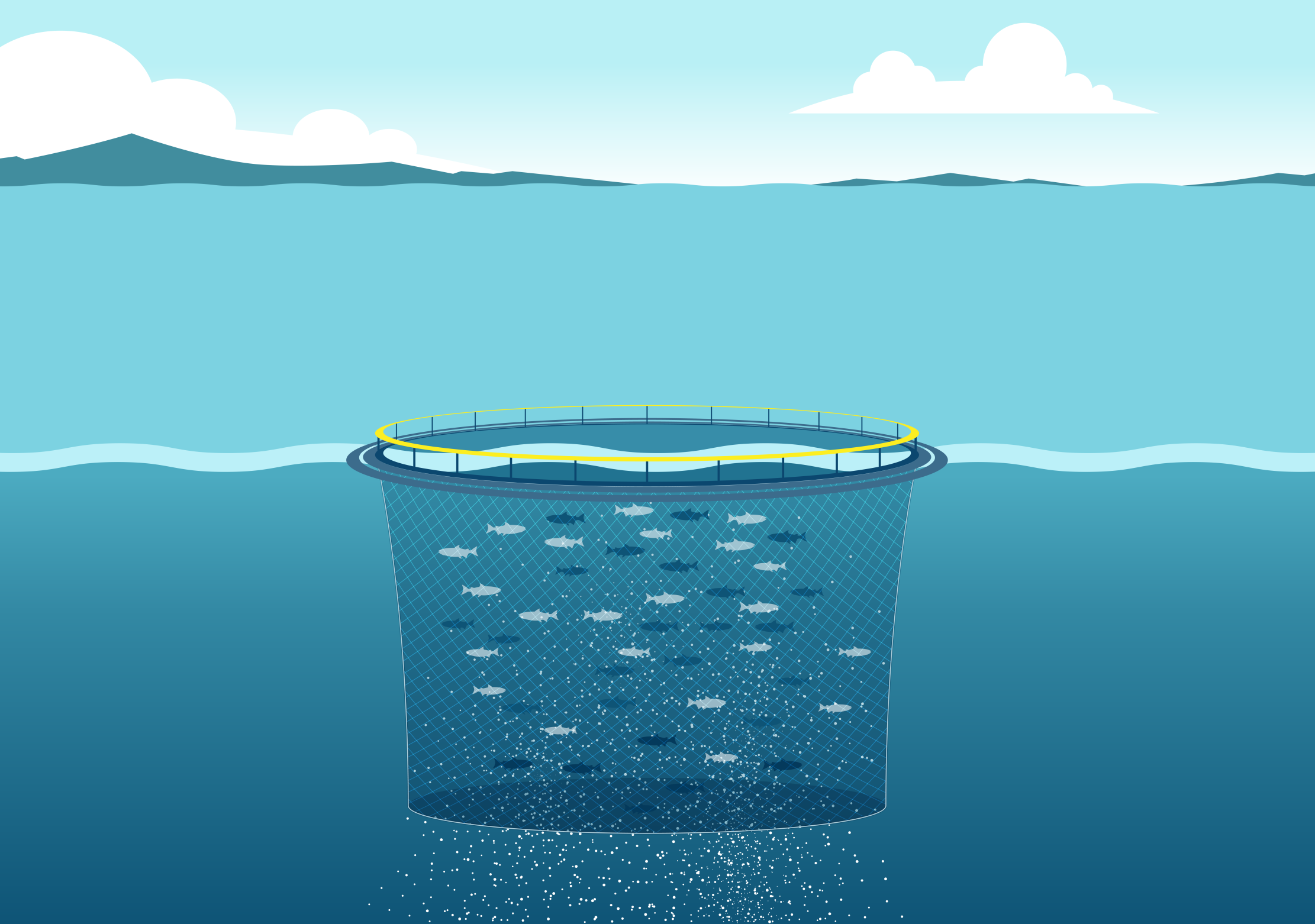

The shale-gas sector extracts, refines and distributes natural gas from between layers of bedrock. This sector is now an important source of natural gas and energy in the US. While China is estimated to have large shale-gas deposits of its own, it lacks the technological resources to exploit them efficiently. As such, China has made significant investments in the US shale-gas sector. However, with geopolitical tensions between the US and China rising, and the need to reduce the environmental impacts of shale-gas exploitation, the risks of Chinese investment require new appraisal. Read More

Towards this aim, Professor Usha Haley of Wichita State University and her colleagues explored the impacts of Chinese investment in US shale gas. They achieved this through interviews with shale industry managers, site visits, and by analyzing patents, federal regulation and industry statistics. They compared pre-Chinese and post-Chinese investment periods from 2000 to 2019 in upstream, midstream and downstream sectors.

Professor Haley and her team found that Chinese investors typically prioritize immediate shale gas production in the US using established technology. After Chinese investment, innovation shifted away from new, environmentally-friendly means of production, to the use of older technologies that cause environmental pollution.

This has disrupted green technology development in the US that is crucial for national security, trade and employment, while contributing to the US losing its lead in environmentally-friendly production. Meanwhile, China has become a leading innovator in green technologies, posing a challenge for US competitiveness, energy security and technology leadership.

The team demonstrated that such Chinese investments in US shale gas have negatively impacted technological development overall, and reduced patenting of environmentally-friendly innovations by American companies. In particular, innovation from small- and medium-sized companies in the US has plummeted.

Such Chinese investments have also altered development in favor of specific technologies that are overwhelmingly in China’s favor, and are better suited for China’s geological terrain.

Although there have been many new regulations designed to curb greenhouse gas emissions associated with shale gas extraction, the team found that such emissions have not decreased significantly, as patents for green technologies have been underused after Chinese investment. Despite this, regulations have not targeted or reduced Chinese investment in US shale gas.

Foreign direct investment can have many benefits, such as facilitating knowledge transfer, spurring domestic innovation, and rectifying market failures. However, investments from less technologically advanced, state-capitalist economies such as China may require caution, targeted regulation and close monitoring.

As the US and China navigate evolving geopolitical tensions, understanding the implications of foreign investment in critical sectors such as shale gas is paramount for safeguarding national interests and technological leadership, while promoting sustainable development.